ZSuite Tech Helps Financial Institutions Grow Deposits

ZSuite Tech Helps Financial Institutions Increase Internal Efficiency

What is ZEscrow? from ZSuite Tech on Vimeo.

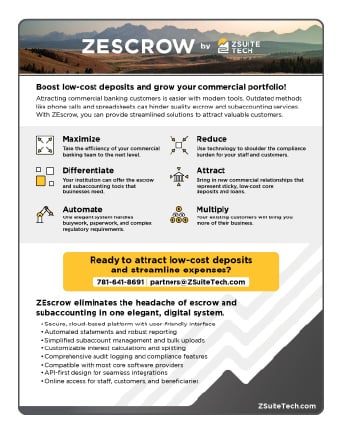

ZEscrow

Commercial banking needs scalable, compliant escrow and subaccounting. ZEscrow replaces legacy methods, letting banks manage complex escrow and subaccounts efficiently at scale.

Banking Technology Partners

Built for specialized commercial verticals:

Property Managers

1031 Exchanges

Municipalities

Law Firms

Trusted by 130+ financial institutions nationwide.

Commercial Escrow FAQ

The way we talk about escrow accounts can also be thought of as three-party accounts.

There are multiple customers (usually individuals) who enter into a contractual relationship with a business and give them money that has to be held for some length of time by the business. The business has a commercial account at a financial institution, usually a bank. So the three parties are the individual consumer, the business and the bank.

The bank holds the money in a business account, but the business needs to know how much money is held on behalf of each customer. One simple example of this is a landlord who is holding a security deposit for the length of time that a renter lives in a property. In some states it is legally mandated that the funds for each security deposit cannot be co-mingled, and interest must be paid to the renter on any money held at an institution. Our platform can handle all of those intricacies.

Attorneys, Landlords, Property Management, Municipalities, Law Firms, Real Estate Offices, Title Companies, Non-Profits, Healthcare, Funeral Homes, 1031 Exchanges, Resident Care, Merger/Acquisition, Bank Operating Systems, Construction, Medical Claims

These are frequently large numbers of accounts with high volumes of transactions.

There is a distinct cost associated with using the core for each individual account. Using our system greatly reduces this cost. Any account opened or closed on the core requires a visit to the bank by a business representative and additional work at the institution. With our secure online option both parties can avoid these manual steps.

The core cannot support complex interest configurations. With ZEscrow, commercial partners can create custom interest configurations to the subaccount level, calculating different interest rates, calculating and splitting interest between the beneficiary and commercial partner, calculating and splitting interest between the commercial partner and a third party, calculating interest rate changes based on length of time account is open or any other ways that compliance or contracts require that interest be split. The interest can be calculated and tracked per subaccount, as well as distributed from your GL.

Many commercial partners have specific needs around three party accounts from an interest calculation, tracking and distributing perspective. That is all simple with ZEscrow.

It is possible to do this without ZEscrow, but it is incredibly manual and time-consuming.

Additionally, with ZEscrow the commercial partner keeps a record at the financial institution of the beneficiary or owner for each of the dollars in the master account, which helps comply with ownership regulations for FDIC Insurance. This message is very relevant right now for reassuring commercial customers with large deposits and many beneficiaries.

- 44,500,000 rental units in US, median rent $2,305 – security deposit potential of $102B.

- 425,285 Law Firms in US ~42,528,500 subs (law firms x 100), average balance of $2000 means $85B in deposits.

- According to the Federation of Exchange Accommodators (FEA), an estimated $100B worth of real estate was exchanged through 1031 exchanges in 2019.

In three-party accounts, the financial institution is the first party, the company (client) is the second party, and the company's customers or beneficiaries are the third party. This arrangement allows the company to hold and manage funds on behalf of their clients with transparency and accuracy.